Why Freight Companies Use Freight Companies

As the owner of your own business, you may be more than aware already of the difficulty in making sure that cash flow issues do not become a problem down the line. After all, the worst thing that can possibly happen for your business is to find yourself embroiled in a long and difficult situation that leaves you forever trying to find the cash you need on an ongoing basis.

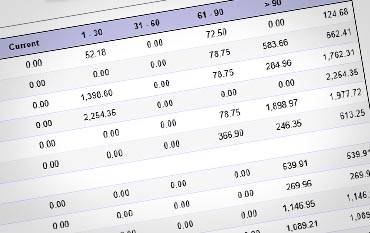

For any business in this situation, the problem can come for waiting for work to clear up and actually be paid into your account. Invoices, checks, and the like can take some time to actually to be processed which can leave you with short-term cash flow issues. Thankfully, there are options out there for businesses to look into – and one of these is receivables factoring companies.

receivables factoring companies will, in exchange for your invoices, provide you with the cash today so that you don't need to worry about the waiting period that could make paying the bills and getting materials more difficult. With this type of setup, invoice receivables factoring can become incredibly useful for many businesses who need to get out of a cash trap which they have found themselves in.

Because, depending on the size of the job, it can take up to 60 days for some businesses to get paid then it's important to cover your own back and not leave yourself cash short to pay the bills. After all, how many businesses have two months revenue just lying there to cover all their expenses until they get paid?

This is especially true of Freight companies. They tend to deal with lots of invoices which means a significant amount of collection time involves business owner themselves. Trying to get paid in time can become an incredible hassle and this is why you use Freight receivables factoring companies who are happy to help out truckers specifically.

As we all know, Freight is an incredibly large industry with many companies out there employing hundreds of drivers. Unfortunately, many of these drivers end up in money troubles because they are still waiting for work from six weeks ago to actually pay them. When this is the situation for a Freight company, turning to receivables factoring companies for assistance might be the best choice left.

This means that a Freight company can pay the wages of the staff, keep all the trucks topped off with fuel and continue to scale, grow and expand without always waiting for the money which is taking too long to come in. Freight Businesses running without a receivables factoring program put in place are leaving themselves at significant risk, as competitors cash out fast and continue to expand.

There's genuinely nothing to be worried about when it comes to using a receivables factoring company – they aren't like a bank or somebody who is going to leave you with a huge pile of debt to pay back. You give them genuine invoices from work you have already finished, you are merely speeding up the payment process.

In the United States, where Freight companies thrive, receivables factoring companies are not considered borrowing in any capacity. This confidential agreement then allows both parties to profit and enjoy a comfortable future – it gives the receivables factoring company a guaranteed asset of income to add to the list and it gives the Freight firm the needed cash that they worked hard to earn.

The Freight company provides their invoices to the receivables factoring company. The Freight receivables factoring company then receive the payments from the Freight company's customers. receivables factoring has been around for hundreds of years and has been used for many years by many different industries – but none more so than truckers. While you may miss out on a small part of the money, something like 1-3% depending on who you work with, it means that you are getting the money today and can actually start putting the money to work.

After all, an IOU or an invoice is not going to pay for expenses, is it? For Freight companies when the money can be good one day and gone the next, it's up to the drivers to work sensibly and to ensure they are leaving themselves with a significant amount of time and finance to get through the week until they are paid again.

So the next time your Freight business is having some short-term cash flow issues and you are spending too much time chasing slow paying clients, why not start considering using a receivables factoring businesses as a way to get your money and give yourself a more comfortable future in the eyes of your Freight staff and your bank balance?